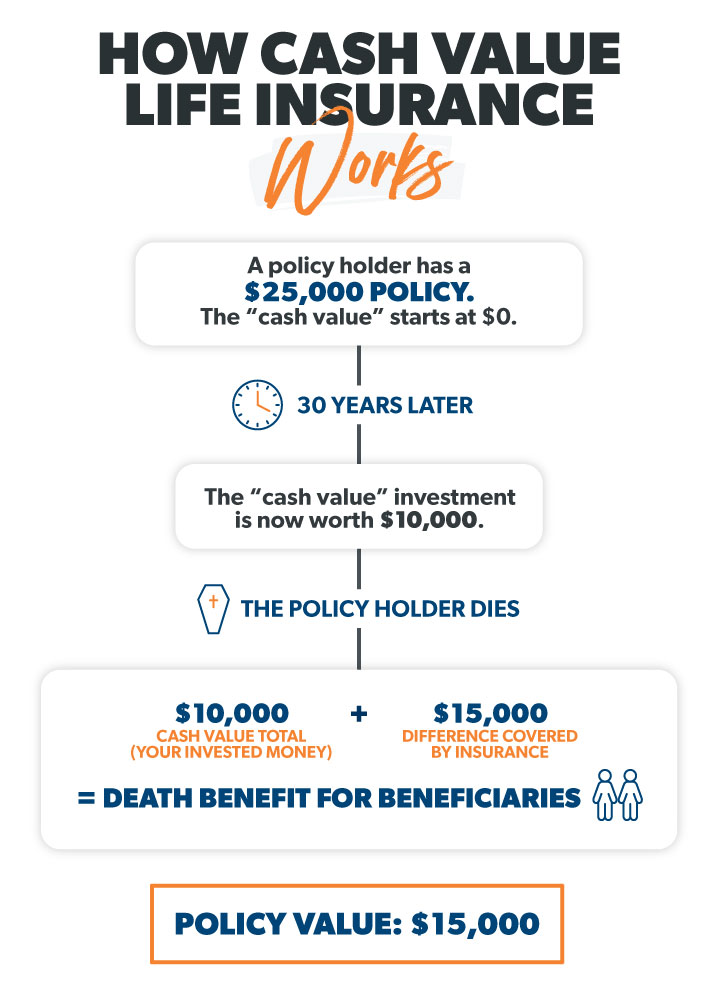

Life insurance with cash value combines a death benefit with a savings component. Policyholders can access the cash value during their lifetime.

Life insurance with cash value offers both financial protection and an investment opportunity. Unlike term life insurance, which only provides a death benefit, cash value life insurance accumulates a savings component over time. This savings can be accessed through loans or withdrawals, offering liquidity and financial flexibility.

Policyholders can use the cash value for various needs, such as emergency funds, retirement planning, or funding significant expenses. These policies often include whole life, universal life, and variable life insurance. Choosing the right policy depends on individual financial goals and needs. Understanding the benefits and drawbacks ensures informed decision-making for long-term financial security.

What Is Cash Value Life Insurance?

Life insurance with cash value is not just about providing a death benefit; it also offers a savings component. This type of insurance builds cash value over time, which policyholders can use in various ways. What is cash value life insurance? It’s a type of permanent life insurance that includes a cash accumulation feature. This cash value grows tax-deferred and can be accessed during the policyholder’s lifetime for various financial needs.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance with a guaranteed cash value. The policy remains active for the insured’s entire life, as long as premium payments are made. This type of policy is known for its stability and reliability.

Key features of whole life insurance include:

- Guaranteed cash value growth: The cash value grows at a fixed rate set by the insurer.

- Policy dividends: Participating policies may pay dividends, which can be used to purchase paid-up additions or reduce premium payments.

- Surrender value: If the policy is surrendered, the policyholder receives the cash value minus any surrender charges.

Whole life insurance also provides living benefits. Policyholders can take policy loans against the cash value for financial needs. Additionally, the cash value growth is tax-deferred, making it a valuable tool for estate planning and financial planning.

| Feature | Benefit |

|---|---|

| Guaranteed Cash Value | Provides stable growth over time |

| Policy Dividends | Potential for additional benefits |

| Surrender Value | Access to funds if policy is surrendered |

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. This type of permanent life insurance includes a cash value component that can earn interest based on market rates.

Key features of universal life insurance include:

- Flexible premiums: Policyholders can adjust premium payments within certain limits.

- Adjustable death benefit: The death benefit can be increased or decreased to meet changing needs.

- Interest-sensitive cash value: The cash value earns interest based on current market rates.

Universal life insurance policies also offer policy loans. Policyholders can borrow against the cash value for various financial needs. The cash accumulation in universal life insurance grows tax-deferred, providing additional benefits for financial and estate planning.

| Feature | Benefit |

|---|---|

| Flexible Premiums | Adjust payments to fit financial situation |

| Adjustable Death Benefit | Customizable coverage amount |

| Interest-Sensitive Cash Value | Potential for higher growth |

Variable Life Insurance

Variable life insurance combines a death benefit with an investment component. This type of permanent life insurance allows policyholders to invest the cash value in various sub-accounts, similar to mutual funds.

Key features of variable life insurance include:

- Investment options: Policyholders can choose from a range of investment sub-accounts.

- Potential for higher returns: The cash value growth depends on the performance of the chosen investments.

- Risk and reward: The cash value can increase or decrease based on market performance.

Variable life insurance offers policyholders the potential for significant cash value growth. Policy loans are available against the cash value, providing flexibility for financial needs. The cash value growth is tax-deferred, making it a valuable tool for long-term financial planning.

| Feature | Benefit |

|---|---|

| Investment Options | Choose from various sub-accounts |

| Potential for Higher Returns | Growth based on market performance |

| Risk and Reward | Potential for significant growth or loss |

How Cash Value Builds Up

Life insurance with cash value is a unique form of permanent life insurance that offers more than just a death benefit. This type of policy includes a savings component that grows over time, providing living benefits while you’re still alive. Understanding how cash value builds up within these policies can help you make informed financial planning decisions.

Premium Payments

Premium payments play a crucial role in the growth of the cash value in a whole life insurance policy. Each time you make a premium payment, a portion of that money goes towards building the cash value. Here’s how it works:

- Coverage Cost: A part of the premium covers the cost of the death benefit.

- Administrative Fees: Some funds go towards administrative fees and managing the policy.

- Cash Value: The remaining amount is allocated to the cash value account.

Let’s look at an example to understand better:

| Premium Payment | Allocation |

|---|---|

| $1000 | $400 for death benefit$100 for administrative fees$500 towards cash value |

Over time, these consistent premium payments contribute significantly to the cash accumulation within your life insurance policy.

Interest Accumulation

Interest accumulation is another key factor in the growth of your cash-value policy. The cash value in whole life insurance and universal life insurance policies earns interest over time. This interest is often compounded, allowing your money to grow faster. There are two types of interest accumulation:

- Guaranteed Interest: Most permanent life insurance policies come with a guaranteed cash value growth, ensuring a minimum interest rate on your cash value.

- Variable Interest: Variable life insurance policies invest your cash value in various investment components like stocks or mutual funds, potentially earning higher returns.

For example:

Initial Cash Value: $10,000

Guaranteed Interest Rate: 3%

Annual Interest Earned: $300

As the interest compounds, the cash value grows exponentially, contributing to a larger surrender value and more substantial living benefits over time.

Dividends

Dividends can further enhance the cash value of your participating policies. Policy dividends are typically paid out by mutual life insurance companies. These dividends are a share of the company’s profits and are distributed to policyholders. You can use dividends in several ways:

- Cash Payout: Receive the dividends as a cash payout.

- Premium Reduction: Use dividends to reduce future premium payments.

- Paid-up Additions: Purchase additional coverage, enhancing both the death benefit and cash value.

For instance, if your policy earns $500 in dividends annually, you could reinvest it for more paid-up additions, boosting the overall cash value and death benefit. This strategy can lead to substantial cash accumulation over the years.

Dividends are not guaranteed, but they provide an excellent opportunity for tax-deferred growth, enhancing the financial planning aspects of your life insurance savings.

Accessing Cash Value

Life insurance with cash value offers more than just a death benefit. It also provides a savings component that accumulates over time. This cash value can be a valuable financial resource. Accessing cash value can be done through several methods, each with its own benefits and considerations. Understanding these options can help you make the most of your policy.

Policy Loans

One common way to access cash value is through policy loans. Policy loans allow you to borrow money against your life insurance policy. The process is straightforward and usually does not require a credit check.

Here are some key points about policy loans:

- Interest Rates: Policy loans often have competitive interest rates.

- No Repayment Schedule: There is no fixed repayment schedule for policy loans.

- Policy Remains Active: The policy stays active as long as the interest is paid.

Consider this example to understand better:

| Loan Amount | Interest Rate | Annual Payment |

|---|---|---|

| $10,000 | 5% | $500 |

While policy loans offer flexibility, unpaid loans can reduce the death benefit. It’s crucial to manage the loan responsibly to avoid complications.

Partial Surrender

Partial surrender is another way to access cash value. This option lets you withdraw a portion of the cash value without terminating the policy. Partial surrender can be useful for meeting immediate financial needs.

Important points to note about partial surrenders:

- Reduces Death Benefit: The death benefit decreases by the amount withdrawn.

- Possible Tax Implications: Withdrawals might be subject to taxes.

- No Interest: Unlike loans, partial surrenders do not accrue interest.

Consider this scenario:

| Original Death Benefit | Withdrawn Amount | New Death Benefit |

|---|---|---|

| $100,000 | $20,000 | $80,000 |

Partial surrenders provide quick access to cash but can impact the overall value of the policy. Weighing the pros and cons is essential before proceeding.

Surrendering The Policy

Surrendering the policy is a method to access the full cash value. This option involves terminating the policy entirely. Surrendering the policy is usually considered a last resort.

Key considerations for surrendering the policy:

- Full Cash Value: You receive the entire cash value minus any surrender charges.

- Loss of Coverage: The policy ends, and no death benefit is provided.

- Taxable Event: The amount received may be subject to taxes.

Example of a surrender scenario:

| Cash Value | Surrender Charges | Net Amount Received |

|---|---|---|

| $50,000 | $5,000 | $45,000 |

Surrendering the policy offers a lump sum but eliminates future benefits. This decision should be made carefully, considering all financial and personal factors.

Credit: www.ramseysolutions.com

Tax Implications

Life insurance with cash value offers more than just a death benefit. It also provides potential tax advantages. Understanding the tax implications can help you make better financial decisions. This section covers three main areas: tax-deferred growth, tax-free withdrawals, and tax consequences of surrender.

Tax-deferred Growth

One of the most attractive features of life insurance with cash value is tax-deferred growth. This means you don’t pay taxes on the growth of your cash value until you withdraw it. This allows your money to grow faster. Here are some key points:

- The cash value grows tax-deferred.

- You don’t pay taxes on the growth each year.

- Taxes are only due upon withdrawal.

Let’s look at an example:

| Year | Premium Paid | Cash Value | Tax Due |

|---|---|---|---|

| 1 | $5,000 | $4,500 | $0 |

| 5 | $25,000 | $30,000 | $0 |

| 10 | $50,000 | $70,000 | $0 |

In this example, the cash value grows without any taxes due each year. This can be a powerful tool for long-term savings.

Tax-free Withdrawals

Life insurance with cash value can provide tax-free withdrawals under certain conditions. You can access your cash value without paying taxes, using one of two methods:

- Policy Loans

- Withdrawals up to the amount of premiums paid

Policy loans allow you to borrow against your cash value. These loans are not taxed as long as the policy remains in force. Here are some benefits:

- No tax on loan amounts.

- Flexible repayment terms.

- Continue to earn interest on cash value.

Withdrawals up to the amount of premiums paid are also tax-free. Here’s how it works:

| Premiums Paid | Cash Value | Withdrawals | Tax Due |

|---|---|---|---|

| $50,000 | $70,000 | $50,000 | $0 |

In this scenario, you can withdraw up to $50,000 tax-free, which is the total amount of premiums paid. This provides a valuable source of tax-free income.

Tax Consequences Of Surrender

While there are many tax advantages, there are also tax consequences of surrender. If you surrender your policy, you may owe taxes on any gains. Here’s what you need to know:

- You pay taxes on gains above premiums paid.

- Gains are taxed as ordinary income.

- Surrendering can result in a large tax bill.

Consider an example:

| Premiums Paid | Cash Value | Gains | Tax Rate | Tax Due |

|---|---|---|---|---|

| $50,000 | $80,000 | $30,000 | 25% | $7,500 |

In this example, surrendering the policy results in a $7,500 tax bill. Understanding these consequences can help you decide whether to keep or surrender your policy.

Benefits Of Cash Value Life Insurance

Life insurance with cash value offers many advantages. This type of policy not only provides a death benefit but also accumulates cash over time. The cash value component can be used for various financial needs, making it a versatile tool in your financial planning. Below, we explore the benefits of cash value life insurance in detail.

Wealth Accumulation

One of the primary benefits of cash value life insurance is wealth accumulation. With a whole life insurance or permanent life insurance policy, a portion of your premium payments goes into a cash-value account. This account grows over time, offering several advantages:

- Tax-deferred growth: The cash value grows without being taxed until it’s withdrawn.

- Investment component: Policies like variable life insurance and universal life insurance allow you to invest in various financial instruments, potentially increasing your cash value.

- Policy dividends: Participating policies may pay dividends, which can be reinvested to buy paid-up additions, further boosting the cash value.

Here’s a simple table to illustrate the growth of cash value over time:

| Year | Cash Value | Policy Dividends |

|---|---|---|

| 1 | $500 | $0 |

| 5 | $5,000 | $200 |

| 10 | $15,000 | $800 |

Utilizing the cash accumulation feature can significantly enhance your financial planning. The guaranteed cash value ensures that you have a secure financial reserve, which can be accessed through policy loans or by surrendering the policy.

Estate Planning

Cash value life insurance also plays a crucial role in estate planning. It offers several benefits that can help secure your family’s future:

- Death benefit: The policy pays a lump sum to your beneficiaries, ensuring financial stability.

- Tax advantages: The death benefit is generally tax-free, providing a significant financial boost.

- Liquidity: The surrender value of the policy can be used to pay estate taxes or other expenses.

These advantages make cash value life insurance an essential component of any comprehensive estate plan. Here’s a comparison of benefits:

| Benefit | Description |

|---|---|

| Death Benefit | Provides financial security to beneficiaries |

| Tax-Free | Death benefit is not subject to income tax |

| Liquidity | Surrender value can cover estate expenses |

Policies such as endowment policies and universal life insurance offer flexible options for estate planning. You can adjust your premiums and death benefits to match your estate planning goals, ensuring your loved ones are well cared for.

Flexibility In Premiums And Death Benefits

Cash value life insurance offers unmatched flexibility in premiums and death benefits. With policies like universal life insurance, you can adjust your premiums based on your financial situation:

- Flexible premiums: Increase or decrease premium payments as needed.

- Adjustable death benefits: Modify the death benefit to meet your changing needs.

- Living benefits: Use the cash value for emergencies or other financial needs.

For example, during financial hardship, you can reduce your premiums without losing coverage. If your financial situation improves, you can increase your premiums to build more cash value. Here’s how flexible premiums work:

| Financial Situation | Premium Adjustment |

|---|---|

| Hardship | Reduce premiums |

| Stability | Maintain premiums |

| Prosperity | Increase premiums |

The ability to adjust premiums and death benefits makes cash value life insurance a versatile tool in your financial planning. You can use policy riders to add extra benefits, enhancing the policy’s value. The non-forfeiture options ensure that you retain some value even if you stop paying premiums, making it a smart choice for long-term financial security.

Considerations Before Purchasing

Life insurance with cash value offers more than just a death benefit. It provides a savings component that grows over time. Before purchasing, consider several factors to ensure it fits your financial goals.

Costs And Fees

Whole life insurance and other cash-value policies come with higher costs compared to term life insurance. Understanding these costs is crucial.

Premium payments for cash-value policies are generally higher. These payments cover both the insurance and the cash accumulation component. Permanent life insurance policies often have extra fees, including:

- Administrative fees for managing the policy.

- Investment management fees for the cash value’s investment component.

- Surrender charges if you cancel the policy early.

The table below outlines typical fees associated with cash-value policies:

| Fee Type | Description | Approximate Cost |

|---|---|---|

| Administrative Fees | Monthly fee for policy management | $5 – $10 per month |

| Investment Management Fees | Annual fee for managing investments | 0.5% – 1.5% of cash value |

| Surrender Charges | Fee for early policy cancellation | 5% – 10% of cash value |

Understanding these costs helps in making an informed decision. Policy dividends from participating policies can offset some costs, but they are not guaranteed.

Long-term Commitment

Purchasing a cash-value policy means committing for the long term. Whole life insurance and other permanent policies are designed to last a lifetime.

Consider the long-term commitment involved:

- Premium payments must be made consistently. Missing payments could result in policy lapse.

- Cash accumulation builds slowly. The significant growth in cash value happens over decades, not years.

- Policy loans allow borrowing against the cash value. Unpaid loans reduce the death benefit.

Examine your financial stability and ability to maintain payments over time. Cash-value policies offer living benefits, like the ability to withdraw or borrow funds. Yet, early withdrawals can affect the guaranteed cash value and surrender value.

Non-forfeiture options provide alternatives if you can’t continue premium payments:

- Reduced paid-up insurance: Lower death benefit but no further premiums needed.

- Extended term insurance: Maintains death benefit for a limited period.

Insurance And Investment Balance

Balancing insurance needs with investment goals is essential. Variable life insurance and universal life insurance combine insurance with investment opportunities.

Consider how the investment component aligns with your financial strategy:

- Policy riders can enhance coverage but add to costs.

- Tax-deferred growth within the policy helps cash value grow without immediate tax liability.

- Policy loans offer access to funds but reduce the overall death benefit.

Review the performance of the investment options within the policy. Universal life insurance offers flexibility in premium payments and death benefits. It’s crucial to understand how this flexibility impacts cash value growth.

Endowment policies provide a lump sum after a specific term, useful for estate planning. The living benefits of cash-value policies offer financial support during life, but need careful management.

Balancing your life insurance policy with investment needs ensures you meet both protection and growth goals. Paid-up additions increase coverage and cash value, enhancing the policy’s benefits.

Analyze your overall financial planning to determine the right mix of insurance and investment. Ensure the cash value growth aligns with long-term objectives and provides the desired life insurance savings.

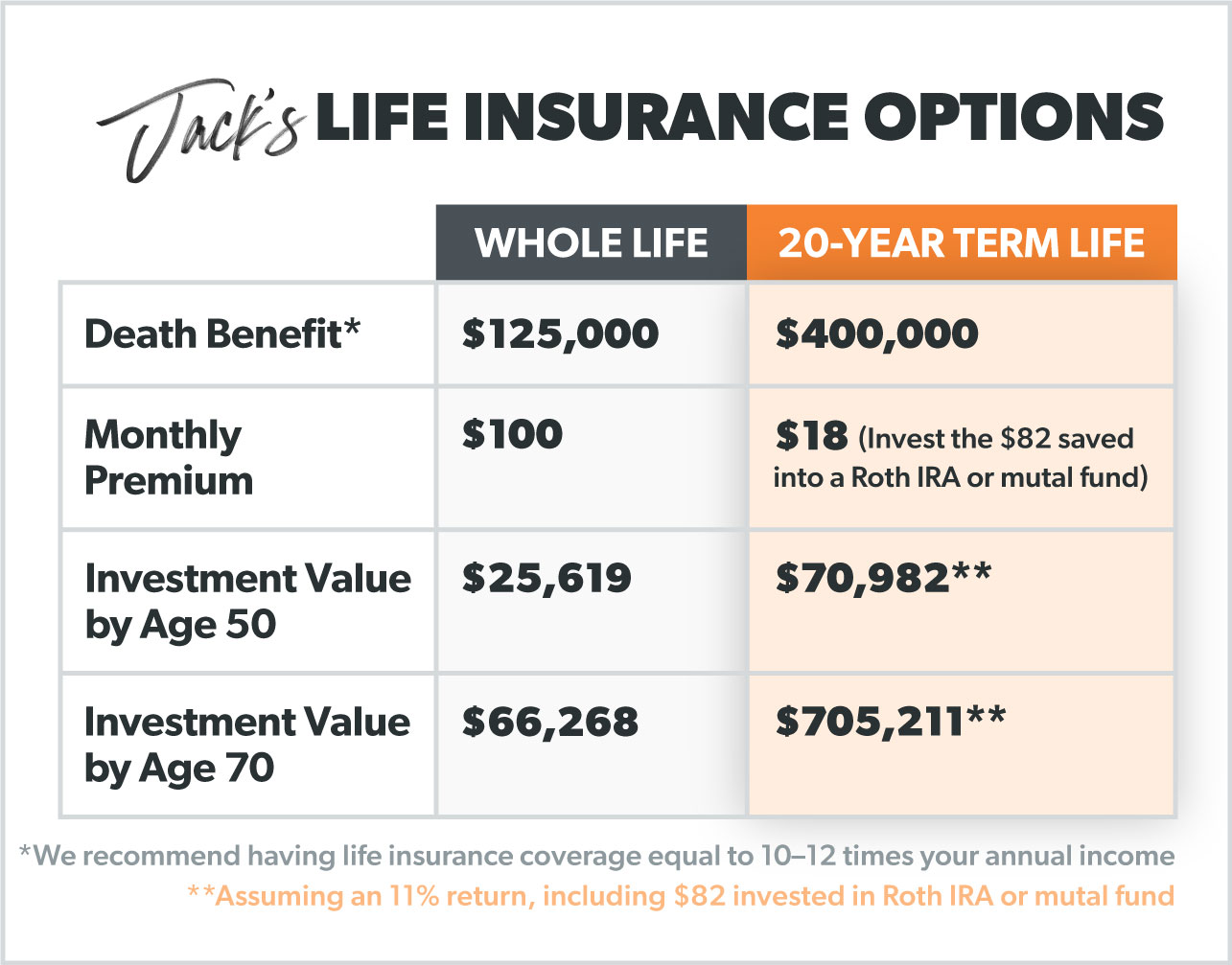

Comparing Cash Value Vs. Term Life Insurance

Life insurance is an important financial tool that provides peace of mind. It helps protect your loved ones from unexpected financial burdens. There are different types of life insurance policies available, each with unique features. One common comparison is between Cash Value Life Insurance and Term Life Insurance. Understanding the differences can help you make an informed choice.

Coverage Duration

One of the key differences between Cash Value Life Insurance and Term Life Insurance is the duration of coverage. Cash Value Life Insurance offers permanent coverage. This means it remains in effect for your entire life, as long as you continue paying the premiums. Term Life Insurance, on the other hand, provides coverage for a specified period, such as 10, 20, or 30 years.

Here is a comparison table for better understanding:

| Policy Type | Coverage Duration |

|---|---|

| Cash Value Life Insurance | Lifetime |

| Term Life Insurance | Specified Term (e.g., 10, 20, 30 years) |

With Cash Value Life Insurance, your beneficiaries receive a death benefit whenever you pass away. Term Life Insurance only pays out if you die during the term of the policy. If the term expires, you need to renew the policy or purchase a new one. This can be more challenging as you age and if your health declines.

Premium Differences

The premiums for Cash Value Life Insurance and Term Life Insurance also differ significantly. Cash Value Life Insurance generally has higher premiums compared to Term Life Insurance. This is because a portion of the premium goes into a cash value account, which can grow over time.

Key differences in premiums include:

- Cash Value Life Insurance: Higher premiums, part of which builds cash value.

- Term Life Insurance: Lower premiums, no cash value accumulation.

For example, a 30-year-old non-smoker might pay approximately $50 per month for a 20-year Term Life policy with a $500,000 death benefit. In contrast, a Cash Value Life Insurance policy with the same death benefit might cost around $300 per month.

Here is an illustrative comparison:

| Policy Type | Monthly Premium | Death Benefit |

|---|---|---|

| Cash Value Life Insurance | $300 | $500,000 |

| Term Life Insurance | $50 | $500,000 |

While Cash Value Life Insurance is more expensive, it provides lifelong coverage and an investment component. Term Life Insurance is more affordable but is limited to the term specified.

Investment Component

Cash Value Life Insurance includes an investment component that sets it apart from Term Life Insurance. With each premium payment, a portion goes into a cash value account. This account can grow over time, based on interest or investment returns. Policyholders can borrow against or withdraw from this cash value.

The investment component offers several benefits:

- Tax-Deferred Growth: The cash value grows on a tax-deferred basis.

- Loan Option: You can borrow against the cash value at a low-interest rate.

- Withdrawal Flexibility: You can withdraw funds, though it may reduce the death benefit.

Term Life Insurance does not have an investment component. It only provides a death benefit if the insured passes away during the term. There’s no cash value accumulation, borrowing, or withdrawal option.

Here’s a comparison:

| Policy Type | Investment Component |

|---|---|

| Cash Value Life Insurance | Yes, with tax-deferred growth and borrowing options |

| Term Life Insurance | No, only a death benefit |

While Cash Value Life Insurance is more complex and costly, it offers additional financial benefits through its investment component. Term Life Insurance is straightforward and budget-friendly but lacks investment features.

Credit: www.ramseysolutions.com

Common Misconceptions

Life Insurance with Cash Value is a financial product that offers both insurance protection and a savings component. Many people misunderstand this type of insurance. These common misconceptions can lead to missed opportunities and incorrect assumptions. This section will address these misconceptions to help you make an informed decision.

High Cost Of Premiums

One common misconception is that Life Insurance with Cash Value is very expensive. While it can be more costly than term insurance, it offers additional benefits. These benefits often justify the higher premiums.

Here are some key points to consider:

- Long-term savings: The cash value builds up over time, providing a financial cushion.

- Tax benefits: The cash value grows tax-deferred, which can be a significant advantage.

- Loan options: You can borrow against the cash value, which can be useful in emergencies.

Here’s a comparison to help illustrate:

| Feature | Term Insurance | Life Insurance with Cash Value |

|---|---|---|

| Premiums | Lower | Higher |

| Cash Value | None | Builds up over time |

| Loan Options | No | Yes |

Complexity Of Products

Another misconception is that Life Insurance with Cash Value is too complex to understand. While these products can be more complicated than term insurance, understanding the basics can demystify them.

Here are the main components:

- Premiums: The payments you make to keep the policy active.

- Death benefit: The amount paid to beneficiaries when the insured passes away.

- Cash value: The savings component that grows over time.

Breaking it down further:

- Whole Life Insurance: Provides coverage for your entire life.

- Universal Life Insurance: Offers flexible premiums and death benefits.

- Variable Life Insurance: Allows you to invest the cash value in various sub-accounts.

Understanding these components can help you choose the right policy for your needs. Always consult a financial advisor for personalized advice.

Limited Investment Options

Many people think Life Insurance with Cash Value offers limited investment options. This is not entirely true. While it may not have as many options as a dedicated investment account, it still offers flexibility.

Consider these options:

- Fixed interest: Some policies offer a guaranteed fixed interest rate on the cash value.

- Indexed interest: Other policies allow the cash value to grow based on a stock market index.

- Variable options: With Variable Life Insurance, you can choose from a range of investment sub-accounts.

Here’s a quick comparison:

| Investment Option | Feature | Risk Level |

|---|---|---|

| Fixed Interest | Guaranteed rate | Low |

| Indexed Interest | Tied to market index | Medium |

| Variable Options | Multiple sub-accounts | High |

Understanding these options can help you make the most of your policy. Always review the investment choices and consult with a financial advisor.

The Role Of An Insurance Agent

Life insurance with cash value offers a unique blend of protection and savings. The role of an insurance agent in this process is crucial. Agents help clients navigate the complexities of life insurance policies, ensuring that they select the best options for their needs. They provide guidance on whole life insurance, permanent life insurance, and cash-value policies, among others. This article explores how insurance agents play a pivotal role in understanding client needs, customizing policies, and conducting annual reviews.

Understanding Client Needs

Insurance agents begin by understanding client needs. They conduct thorough interviews to gather crucial information about the client’s financial situation, goals, and risk tolerance. This helps in recommending the right life insurance policy, whether it’s a whole life insurance, variable life insurance, or universal life insurance.

Agents ask questions to uncover details like:

- Financial goals: Are you saving for retirement, your children’s education, or estate planning?

- Risk tolerance: Are you comfortable with an investment component in your life insurance savings?

- Current financial obligations: Do you have outstanding debts or dependents relying on your income?

After gathering this information, agents analyze it to match clients with the most suitable policies. They explain the living benefits of cash-value policies, such as policy loans, tax-deferred growth, and cash accumulation. Agents also clarify how different policies offer non-forfeiture options like surrender value and paid-up additions.

Policy Customization

Once the client’s needs are understood, the agent focuses on policy customization. This involves tailoring the policy details to fit the client’s specific situation. Agents customize various aspects, including premium payments, death benefit, and optional policy riders.

Customization can involve:

- Choosing the right type of policy: Whole life insurance, universal life insurance, or variable life insurance.

- Adjusting premium payments: Structuring premiums to align with the client’s budget.

- Adding policy riders: Enhancements like accidental death benefit, waiver of premium, or critical illness rider.

Agents also provide options for participating policies that offer policy dividends. They discuss guaranteed cash value and how it contributes to cash value growth. Additionally, they explain the benefits of endowment policies and how they can be part of a broader financial planning strategy.

Annual Policy Reviews

Regular annual policy reviews are essential to ensure the life insurance policy remains aligned with the client’s evolving needs. During these reviews, agents reassess the client’s financial situation, goals, and any changes in their life circumstances.

Key aspects of annual reviews include:

- Evaluating cash value growth: Checking the performance of the cash-value component.

- Adjusting coverage: Modifying the death benefit or adding new riders as needed.

- Reviewing premium payments: Ensuring premiums are still affordable and in line with the client’s budget.

Agents also discuss policy dividends and how they can be used, such as purchasing paid-up additions or reducing future premiums. They review the surrender value and advise on policy loans if needed. This ongoing financial planning ensures the life insurance policy continues to meet the client’s needs, providing peace of mind and security.

Case Studies

Life insurance with cash value offers a unique financial safety net. It not only protects your loved ones but also builds a savings component. Case studies highlight the practical benefits and real-world applications of these policies. They provide a vivid picture of how life insurance with cash value can impact everyday lives.

Real-life Examples

Meet Jane, a 35-year-old professional with two kids. She chose a life insurance policy with cash value. Over the years, she watched her policy’s cash value grow. Eventually, she used the accumulated cash to fund her children’s college education.

Here’s another example: Tom, a 50-year-old entrepreneur, invested in a whole life insurance policy. By the time he turned 60, he had built a significant cash value. He utilized this cash to support his new startup without taking a loan.

These examples show the versatility of life insurance with cash value. Policyholders can:

- Pay for unexpected expenses

- Fund education

- Support new ventures

Real-life examples demonstrate how these policies provide both protection and financial flexibility.

Impact On Beneficiaries

Life insurance with cash value significantly impacts beneficiaries. When the policyholder passes away, beneficiaries receive the death benefit. This financial support helps them maintain their standard of living.

Consider Sarah, who lost her husband unexpectedly. His life insurance policy with cash value provided a death benefit that covered funeral expenses and paid off their mortgage. Sarah and her children could stay in their family home.

Here’s a quick overview of the benefits for beneficiaries:

| Benefit | Description |

|---|---|

| Financial Security | Provides a lump sum to cover expenses |

| Debt Relief | Helps pay off loans and mortgages |

| Future Planning | Supports long-term goals like education |

These examples illustrate the profound impact life insurance with cash value can have on beneficiaries. It ensures they are financially secure in challenging times.

Regulatory Considerations

Understanding the regulatory considerations for life insurance with cash value is essential for making informed decisions. These regulations ensure consumer protection, transparency, and fair practices. This section dives deep into state insurance regulations, consumer protection laws, and disclosure requirements.

State Insurance Regulations

State insurance regulations play a vital role in governing life insurance policies with cash value. Each state has its own set of rules and guidelines. These rules ensure that life insurance companies operate fairly and transparently. Key points include:

- Licensing Requirements: Insurance companies must obtain a license to operate in each state.

- Financial Solvency: States require insurers to maintain a certain level of financial stability. This ensures they can meet policyholder claims.

- Policy Approval: States often review and approve policy forms and rates. This prevents unfair practices and protects consumers.

Below is a table summarizing some state-specific regulations:

| State | Key Regulation |

|---|---|

| California | Strict disclosure requirements for policy terms. |

| New York | High standards for financial solvency of insurers. |

| Texas | Mandatory policy review and approval by the state. |

Consumer Protection Laws

Consumer protection laws are designed to safeguard policyholders. These laws ensure that life insurance companies engage in ethical practices. Important aspects include:

- Grace Periods: Laws mandate a grace period for late premium payments. This prevents policy cancellations due to minor delays.

- Free Look Period: New policyholders can review their policy for a certain period. They can cancel without penalty within this timeframe.

- Non-Discrimination: Insurers cannot discriminate based on gender, race, or other protected characteristics.

These laws create a safety net for consumers, ensuring they receive fair treatment and transparency.

Disclosure Requirements

Disclosure requirements ensure that consumers are fully informed about their life insurance policies. These requirements mandate insurers to provide clear and comprehensive information. Key elements include:

- Policy Terms: Insurers must disclose all terms and conditions of the policy. This includes benefits, limitations, and exclusions.

- Fees and Charges: All fees and charges associated with the policy must be clearly stated. This prevents hidden costs.

- Cash Value Information: Detailed information about the cash value component must be provided. This includes how it grows and how it can be accessed.

Effective disclosure builds trust between insurers and policyholders, fostering a transparent relationship.

Future Trends

Life insurance with cash value has always been a popular choice for those seeking financial security. The future trends in this sector show promising advancements that will benefit policyholders. These trends bring new innovations and better integration with financial planning strategies, ensuring comprehensive coverage and financial growth.

Innovations In Cash Value Products

Innovations in cash value products are reshaping the life insurance landscape. Insurers are now offering more flexible and customizable policies. These modern policies cater to individual financial goals and needs.

Some key innovations include:

- Indexed Universal Life Insurance (IUL): This allows policyholders to earn interest based on stock market indexes.

- Variable Universal Life Insurance (VUL): Offers investment options within the policy, providing potential for higher returns.

- Enhanced Policy Riders: New riders cover critical illnesses, long-term care, and disability, adding more value to the policy.

These products now integrate with digital platforms, offering easy access and management. Policyholders can track the performance of their investments and make changes in real-time. This digital integration ensures that policies remain relevant and adaptable to changing financial landscapes.

| Policy Type | Features |

|---|---|

| Indexed Universal Life | Interest based on stock market indexes |

| Variable Universal Life | Investment options within the policy |

| Enhanced Policy Riders | Additional coverage for critical illnesses, long-term care, disability |

Integration With Financial Planning

The integration of life insurance with financial planning is another significant trend. Today, life insurance is not just about death benefits. It plays a crucial role in comprehensive financial strategies.

Here are some ways life insurance integrates with financial planning:

- Retirement Planning: Cash value can be used as a source of retirement income.

- Tax Benefits: Life insurance policies offer tax-deferred growth on the cash value.

- Wealth Transfer: Policies provide a way to transfer wealth to beneficiaries efficiently.

Financial advisors now recommend life insurance as part of a balanced portfolio. It offers a safety net while also contributing to long-term financial goals. The cash value component can be accessed for various needs, such as education, emergencies, or business opportunities.

Integrating life insurance with financial planning ensures a holistic approach. It provides security, growth, and flexibility. Policyholders can achieve their financial objectives while protecting their loved ones.

Frequently Asked Questions: life insurance with cash value

Which Life Insurance Has Cash Value?

Whole life insurance and universal life insurance have cash value. These policies build savings over time.

What Is The Disadvantage Of Cash Value Life Insurance?

Cash value life insurance has higher premiums. It offers lower returns compared to other investments. Complexity can confuse policyholders.

What Is The Cash Value Of A $100,000 Life Insurance Policy?

The cash value of a $100,000 life insurance policy varies. Factors include the policy type, premiums paid, and policy duration. Contact your insurer for an accurate estimate.

Can I Withdraw My Cash Value From Life Insurance?

Yes, you can withdraw your cash value from life insurance. However, withdrawing may reduce the death benefit. Consult your policy terms.

What Is Life Insurance With Cash Value?

Life insurance with cash value is a policy that builds savings over time, providing both a death benefit and a cash component.

Conclusion

Life insurance with cash value offers both protection and savings. It provides financial security and a smart investment. Consider your needs and future goals. This type of policy can be a valuable asset. Make an informed decision to secure your family’s future and grow your wealth.