How Much Does Health Insurance Cost? Health insurance costs vary widely, averaging $456 per month for individuals and $1,152 for families in the USA. Prices depend on factors like age, location, and plan type.

Health insurance is essential for managing healthcare expenses. Costs can be a significant concern, especially with varying premiums and out-of-pocket expenses. Different factors influence the price, including your age, location, and the type of coverage you choose. Employer-sponsored plans often cost less than private ones.

Subsidies are available for low-income individuals under the Affordable Care Act, helping to reduce costs. Comparing different plans and understanding your healthcare needs can help you find the most cost-effective option. Researching and carefully selecting your health insurance can ensure you get the coverage you need without overspending.

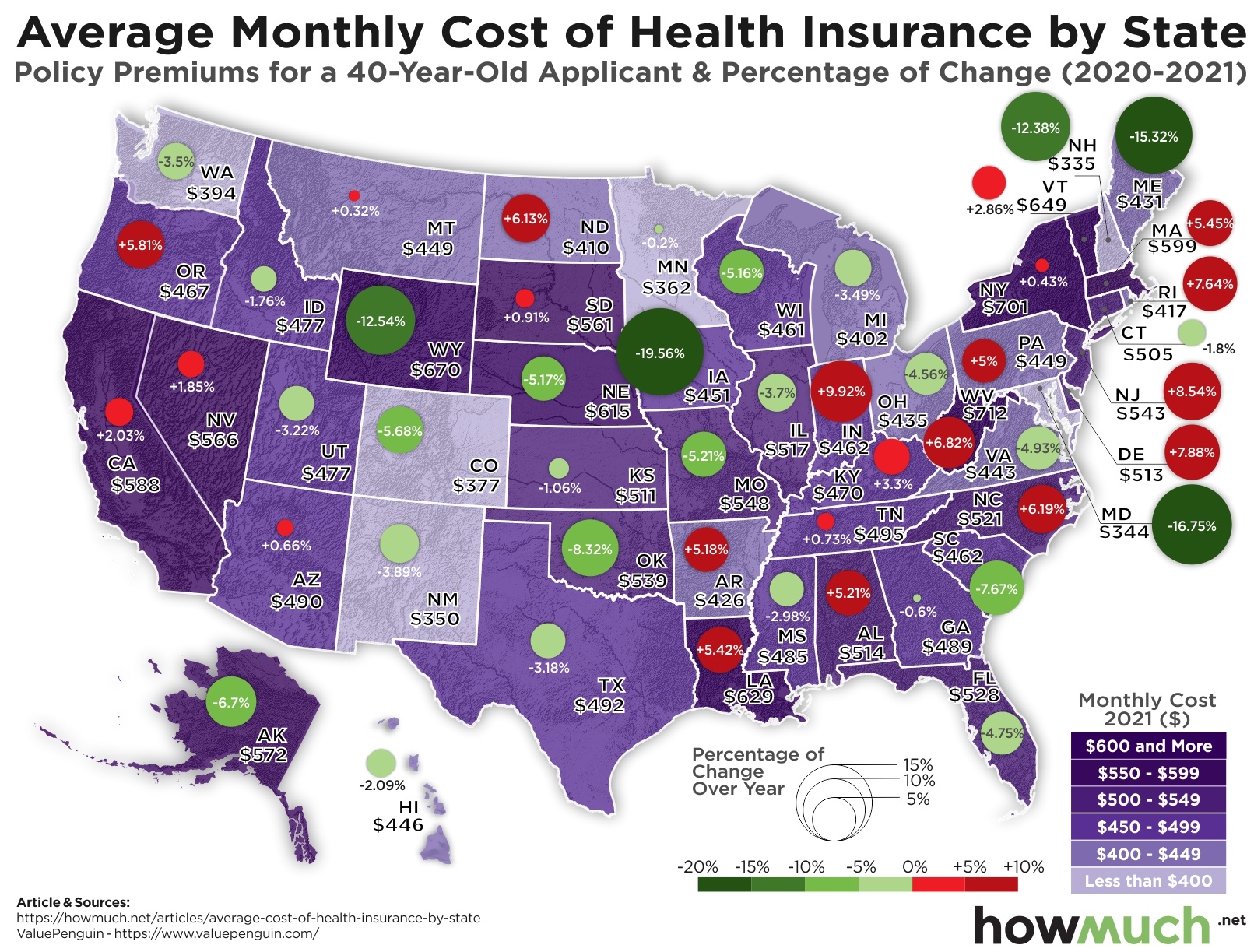

Credit: howmuch.net

Factors Affecting Health Insurance Costs

Understanding how much health insurance costs can be complex. Several factors influence these costs, making it important to know what affects your premiums. Here, we explore the key factors affecting health insurance costs.

Age And Health Status

One of the most significant factors affecting health insurance costs is age. Younger individuals typically pay lower premiums compared to older adults. This is because they are generally healthier and less likely to need extensive medical care.

Health status also plays a crucial role. Insurers assess your health through medical questionnaires or check-ups. Those with pre-existing conditions may face higher premiums. This is due to the anticipated higher medical expenses.

- Younger individuals: Lower premiums

- Older adults: Higher premiums

- Healthy individuals: Lower premiums

- Individuals with pre-existing conditions: Higher premiums

Take a look at the table below for a clearer view:

| Age Group | Average Monthly Premium |

|---|---|

| 18-29 | $150 |

| 30-39 | $200 |

| 40-49 | $300 |

| 50-64 | $400 |

Location And State Regulations

Your location greatly influences health insurance costs. Different states have various regulations that can affect premiums. Some states have more strict regulations, which can lead to higher premiums.

States with higher living costs often have higher health insurance premiums. Urban areas may also have higher rates compared to rural areas due to the increased cost of healthcare services.

- Urban areas: Higher premiums

- Rural areas: Lower premiums

- States with strict regulations: Higher premiums

- States with fewer regulations: Lower premiums

Here’s a brief comparison:

| Location | Average Monthly Premium |

|---|---|

| California (Urban) | $450 |

| Texas (Rural) | $300 |

| New York (Urban) | $500 |

| Ohio (Rural) | $350 |

Type Of Plan And Coverage

The type of plan and the level of coverage you choose also impact costs. There are several types of plans, including Employer-sponsored insurance, Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and High Deductible Health Plan (HDHP).

Employer-sponsored insurance often offers lower premiums because employers share the cost. HMO plans typically have lower premiums but require you to use a network of doctors. PPO plans offer more flexibility in choosing doctors but come with higher premiums. HDHPs have lower premiums but higher deductibles, making them suitable for individuals who do not expect high medical expenses.

- Employer-sponsored insurance: Lower premiums

- HMO plans: Lower premiums, network restrictions

- PPO plans: Higher premiums, more flexibility

- HDHPs: Lower premiums, higher deductibles

See the table below for a quick comparison:

| Type of Plan | Average Monthly Premium | Deductible |

|---|---|---|

| Employer-sponsored | $200 | $1,000 |

| HMO | $250 | $1,500 |

| PPO | $350 | $1,200 |

| HDHP | $150 | $5,000 |

Average Health Insurance Costs

Health insurance costs can vary widely. Understanding the average costs can help you make informed decisions. The costs depend on your plan type, location, and other factors. Let’s dive into the average health insurance costs.

National Average Costs

Health insurance costs differ based on plan types. The Catastrophic insurance is the cheapest but offers limited coverage. The Bronze plan has low premiums but high deductibles. The Silver plan balances premiums and deductibles. The Gold plan has higher premiums and lower deductibles. The Platinum plan offers the highest premiums with the lowest deductibles.

Here’s a breakdown of the average monthly premiums for each plan type:

| Plan Type | Average Monthly Premium |

|---|---|

| Catastrophic | $173 |

| Bronze | $388 |

| Silver | $428 |

| Gold | $482 |

| Platinum | $583 |

These costs are averages, so your actual costs might be different. Factors like age, smoking status, and location influence your premiums. Younger people usually pay less. Smokers often pay more. Urban areas tend to have higher premiums than rural areas.

Cost Disparities In Different States

Health insurance costs also vary by state. Some states have higher premiums due to healthcare costs and regulations. For example, Alaska has some of the highest premiums. On the other hand, Massachusetts often has lower premiums. These differences can be significant.

Here’s a look at the average monthly premiums in different states:

| State | Average Monthly Premium |

|---|---|

| Alaska | $780 |

| Massachusetts | $390 |

| Florida | $456 |

| California | $430 |

| Texas | $470 |

Factors influencing these disparities include state healthcare policies, the number of insurers, and the overall health of the population. States with more insurers often have lower premiums due to competition. States with healthier populations might see lower premiums too.

Understanding these disparities can help you budget better. Remember, these are averages. Your personal health, family size, and other factors will impact your actual costs.

Costs Of Employer-sponsored Health Insurance

Health insurance costs can vary widely, but employer-sponsored health insurance is a common way for many people to get coverage. Understanding the costs involved in employer-sponsored health insurance is crucial. These costs are typically shared between the employee and the employer, making it important to know how much each party contributes.

Employee Contributions

Employee contributions are the portion of health insurance premiums that employees pay. These costs are often deducted directly from paychecks, making it a convenient way to manage health insurance payments. Here are some key points about employee contributions:

- Premiums: Employees usually pay a portion of the monthly premium. This amount can vary based on the plan selected.

- Deductibles: Employees may have to meet a deductible before the insurance starts to pay. This can range from a few hundred to several thousand dollars.

- Co-pays: Employees often pay a co-pay for doctor visits and prescriptions. This is a fixed amount paid at the time of service.

Here is a simple table showing average costs:

| Type of Contribution | Average Cost (Annual) |

|---|---|

| Premiums | $1,200 – $1,500 |

| Deductibles | $1,000 – $2,500 |

| Co-pays | $20 – $50 per visit |

Employer Contributions

Employer contributions are the portion of health insurance premiums paid by the employer. This helps reduce the overall cost for employees. Here are some key points about employer contributions:

- Percentage Covered: Employers typically cover a significant portion of the monthly premium, often between 70% and 90%.

- Plan Options: Employers may offer several health plan options, and their contributions can vary based on the plan chosen.

- Additional Benefits: Some employers also offer Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to help employees manage out-of-pocket costs.

Here is a simple table showing average costs covered by employers:

| Type of Contribution | Percentage Covered |

|---|---|

| Premiums | 70% – 90% |

| HSAs/FSAs | Varies |

By understanding both employee and employer contributions, you can better manage your health insurance costs and make informed decisions about your coverage options.

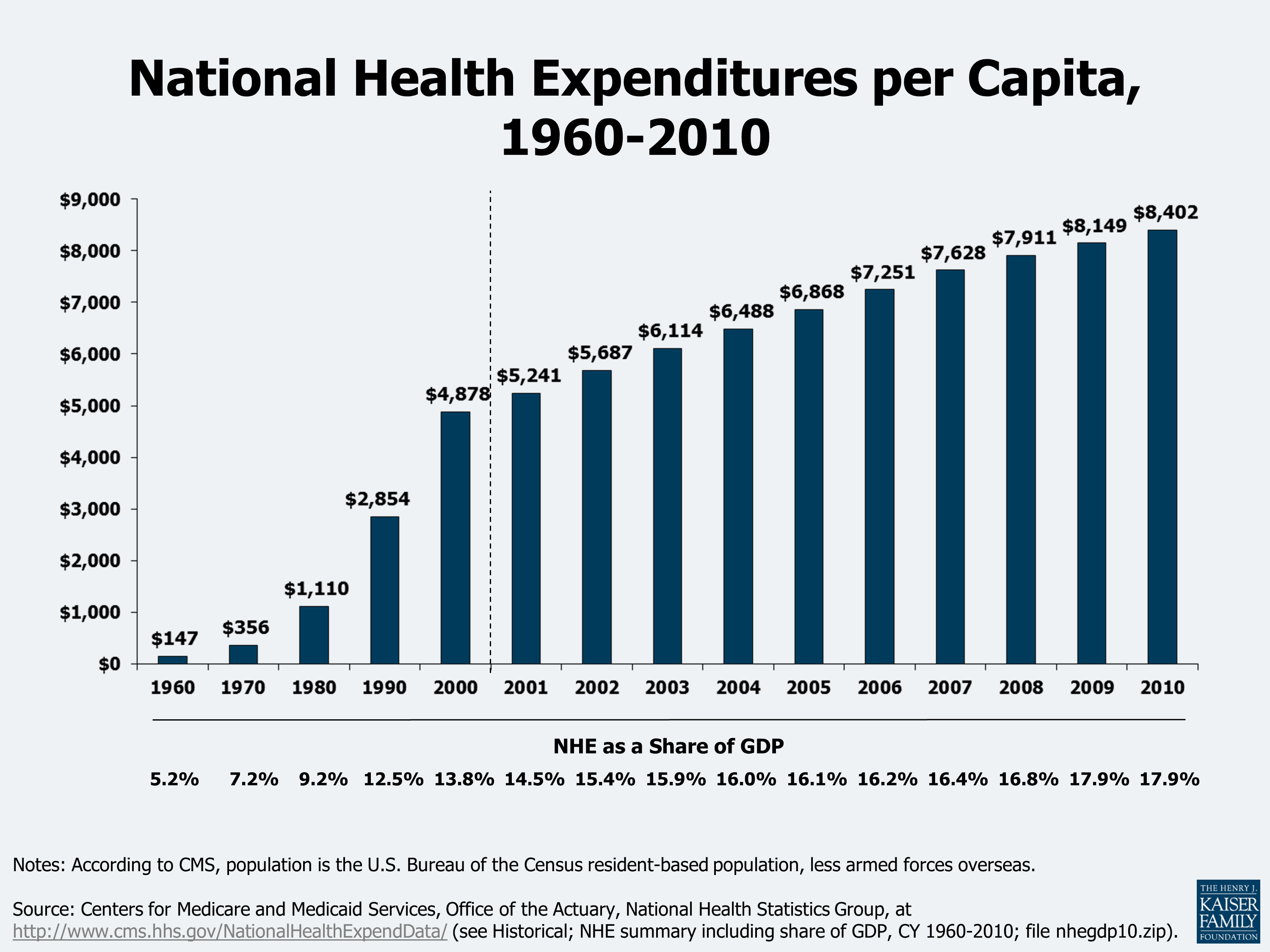

Credit: www.kff.org

Individual Health Insurance Costs

Determining the cost of health insurance can seem complex. Various factors influence how much you pay. Individual health insurance costs vary based on plan types, coverage, and personal circumstances. Understanding these costs helps you make informed decisions about your healthcare.

Marketplace Plans

Marketplace plans are health insurance policies available through the Health Insurance Marketplace. These plans come in different tiers: Bronze, Silver, Gold, and Platinum. Each tier offers varying levels of coverage and costs. Here’s a quick breakdown:

- Bronze Plans: Lower monthly premiums but higher out-of-pocket costs. Suitable if you don’t expect to need much medical care.

- Silver Plans: Moderate monthly premiums and out-of-pocket costs. Good for balanced coverage.

- Gold Plans: Higher monthly premiums but lower out-of-pocket costs. Ideal for those expecting frequent medical care.

- Platinum Plans: Highest monthly premiums but lowest out-of-pocket costs. Best for those who need a lot of medical care.

Each plan has different premiums, deductibles, co-pays, and out-of-pocket maximums. To give you an idea, here’s a table showing average monthly premiums for each tier:

| Plan Tier | Average Monthly Premium |

|---|---|

| Bronze | $400 |

| Silver | $500 |

| Gold | $600 |

| Platinum | $700 |

Keep in mind that your exact costs depend on your age, location, and income. Subsidies and tax credits may also reduce your premiums if you qualify.

Direct Purchase Plans

Direct purchase plans are bought directly from insurance companies, not through the marketplace. These plans offer flexibility but may cost more. Here’s what you need to know:

- Variety of Options: Direct purchase plans come in many forms, including HMOs, PPOs, and EPOs.

- Customized Coverage: You can tailor the coverage to meet your specific needs.

- Higher Costs: These plans may have higher premiums and out-of-pocket costs compared to marketplace plans.

To help you understand, here’s a comparison of average monthly premiums for direct purchase plans:

| Plan Type | Average Monthly Premium |

|---|---|

| HMO | $450 |

| PPO | $550 |

| EPO | $500 |

Direct purchase plans may offer more personalized options but can be pricier. Evaluating your healthcare needs and budget helps you decide if these plans suit you.

Additional Costs And Considerations

Health insurance costs can be complex and vary widely. It’s essential to understand the additional costs and considerations that come with your health insurance plan. These extra expenses can significantly impact your overall healthcare budget.

Deductibles And Copayments

Deductibles and copayments are crucial parts of any health insurance plan. The deductible is the amount you pay out-of-pocket before your insurance starts to cover expenses. Deductibles can range from a few hundred to several thousand dollars.

Copayments, or copays, are fixed amounts you pay for specific services. These usually apply to doctor visits, specialist consultations, and emergency room visits. Here’s a quick look at typical copayment amounts:

| Service | Typical Copay |

|---|---|

| Primary Care Visit | $20-$40 |

| Specialist Visit | $30-$60 |

| Emergency Room | $100-$200 |

Some plans also have coinsurance, which is a percentage of costs you pay after meeting your deductible. For example, if your coinsurance rate is 20%, you pay 20% of the bill, and the insurance covers the rest.

Prescription Drug Costs

Prescription drug costs can add up quickly. Most insurance plans have a formulary, which is a list of covered medications. Drugs not on this list may cost more. There are different tiers in formularies:

- Tier 1: Generic drugs, lowest cost

- Tier 2: Preferred brand-name drugs, moderate cost

- Tier 3: Non-preferred brand-name drugs, higher cost

- Tier 4: Specialty drugs, highest cost

Pharmacy benefits often come with their own set of copayments or coinsurance. Here’s a snapshot of what you might expect:

| Drug Type | Typical Cost |

|---|---|

| Generic | $10-$20 |

| Preferred Brand | $30-$50 |

| Non-Preferred Brand | $50-$100 |

| Specialty | $100-$500+ |

Out-of-network Costs

Out-of-network costs can be a surprise expense. In-network providers have agreements with your insurance, offering lower rates. Out-of-network providers do not, often leading to higher bills.

Here’s what you need to know:

- Higher Coinsurance: You may pay a higher percentage of the bill.

- Balance Billing: Providers may bill you for the difference between their charge and what insurance pays.

- No Maximum Out-of-Pocket: Out-of-network costs might not count toward your annual out-of-pocket maximum.

Consider this example:

| Service | In-Network | Out-of-Network |

|---|---|---|

| Office Visit | $20 Copay | 40% Coinsurance |

| Surgery | 20% Coinsurance | 50% Coinsurance + Balance Billing |

Understanding these additional costs can help you make informed decisions about your health insurance plan. Always check the details of your policy to avoid unexpected expenses.

Ways To Lower Health Insurance Costs

Health insurance costs can be daunting for many. Balancing between adequate coverage and affordability is key. There are several ways to lower health insurance costs. Here are some effective strategies to help you save money while maintaining good coverage.

Wellness Programs

Many insurers offer wellness programs to help reduce health insurance costs. These programs encourage healthy behaviors and provide rewards for participation. Below are common features of wellness programs:

- Fitness Incentives: Discounts or cash rewards for gym memberships and regular exercise.

- Preventive Care: Free or low-cost screenings, vaccinations, and check-ups.

- Health Education: Access to resources on nutrition, stress management, and chronic disease prevention.

Participating in these programs can lower your insurance premiums and improve your overall health. Engaging in wellness programs is a proactive way to manage health care costs.

High-deductible Plans With Hsas

High-deductible health plans (HDHPs) combined with a Health Savings Account (HSA) can be a cost-effective option. HDHPs have lower premiums but higher out-of-pocket costs. Here’s how it works:

| Feature | HDHP | HSA |

|---|---|---|

| Premiums | Lower | N/A |

| Deductibles | Higher | N/A |

| Tax Advantages | No | Yes |

Contributions to an HSA are tax-deductible. Withdrawals for medical expenses are tax-free. HSAs can also earn interest and roll over year to year.

This combination allows for lower monthly costs and tax savings. It’s a great way to prepare for future medical expenses without breaking the bank.

Health Maintenance Organizations (hmos)

Health Maintenance Organizations (HMOs) offer another way to lower health insurance costs. HMOs provide care through a network of doctors and hospitals. Here are the benefits:

- Lower Premiums: HMOs often have lower premiums compared to PPOs.

- Coordinated Care: Primary care doctors manage your health care and referrals.

- Predictable Costs: Fixed co-pays for visits and prescriptions.

HMOs require you to use network providers, which may limit your choices. But the savings can be significant. It’s ideal for those who don’t mind having a primary care physician coordinate their care.

Student Health Insurance Cost Premium Cost Calculation Health Insurance Fee Senior Health Insurance Cost Cost Estimate For Health Plans Health Insurance Cost Forecast Marketplace Insurance Plans

Understanding different demographics’ needs can also help in lowering health insurance costs. Here are some considerations:

- Student Health Insurance: Often cheaper and tailored for young adults. Schools may offer plans or partnerships with insurers.

- Premium Cost Calculation: Consider income, age, and coverage level. Use online calculators for estimates.

- Senior Health Insurance: Medicare and supplemental plans can reduce costs. Look for plans that cover specific needs.

- Cost Estimate for Health Plans: Compare plans on the marketplace. Check for subsidies based on income.

- Health Insurance Cost Forecast: Stay updated on trends. Premiums may change yearly.

Marketplace insurance plans offer a range of options. Evaluate them based on coverage needs and budget. Use Flexible Spending Accounts (FSAs) for additional savings on qualified medical expenses. Consider short-term health insurance for gaps in coverage, but be aware of limitations.

Government Assistance Programs

The cost of health insurance can be high, but Government Assistance Programs can help make it more affordable. These programs are designed to support those who need financial help to get the health coverage they need. Let’s explore some of the key programs available.

Medicaid

Medicaid is a state and federal program that provides health coverage for low-income individuals and families. It covers a wide range of health services. Eligibility is based on income, family size, and other factors.

Here are some key points about Medicaid:

- Income-based: Your income must be below a certain level to qualify.

- No premiums: Most Medicaid recipients do not pay monthly premiums.

- Comprehensive coverage: Includes doctor visits, hospital stays, long-term care, and more.

- Children and pregnant women: Special coverage options are available for these groups.

Medicaid eligibility can vary by state. Some states have expanded Medicaid under the Affordable Care Act (ACA), offering coverage to more people.

| State | Medicaid Expansion |

|---|---|

| California | Yes |

| Florida | No |

To apply for Medicaid, visit your state’s Medicaid office or website. You may need to provide proof of income, identity, and residency.

Chip

CHIP (Children’s Health Insurance Program) provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid but cannot afford private insurance.

Key features of CHIP include:

- Low-cost premiums: Many families pay low monthly premiums, and some pay no premiums.

- Comprehensive coverage: Includes routine check-ups, immunizations, doctor visits, prescriptions, dental and vision care, and inpatient and outpatient hospital care.

- Eligibility: Varies by state but generally covers children up to age 19.

Each state runs its own CHIP program with its own rules. Some states have combined CHIP with Medicaid.

| State | CHIP Eligibility |

|---|---|

| Texas | Up to 18 |

| New York | Up to 19 |

To apply for CHIP, contact your state’s CHIP office or visit their website. You’ll need to provide information about your income, family size, and residency.

Subsidies For Marketplace Plans

Subsidies for Marketplace Plans help lower the cost of health insurance purchased through the Health Insurance Marketplace. These subsidies come in two forms: premium tax credits and cost-sharing reductions.

Premium tax credits reduce the monthly premium you pay for insurance. Cost-sharing reductions lower your out-of-pocket costs for deductibles, copayments, and coinsurance.

Eligibility for subsidies depends on:

- Income: Your income must be between 100% and 400% of the federal poverty level (FPL).

- Household size: Larger households may qualify with higher incomes.

- Marketplace enrollment: You must enroll in a plan through the Health Insurance Marketplace.

Here’s a quick look at the FPL guidelines:

| Household Size | 100% FPL | 400% FPL |

|---|---|---|

| 1 | $12,880 | $51,520 |

| 4 | $26,500 | $106,000 |

To apply for subsidies, visit the Health Insurance Marketplace website. You’ll need to provide information about your income, household size, and current health insurance status.

Credit: www.ramseysolutions.com

Impact Of Healthcare Policy Changes

Health insurance costs can vary widely. One major factor is healthcare policy changes. Policy changes can impact premiums, coverage options, and out-of-pocket costs. Understanding these changes helps you make informed decisions.

Affordable Care Act (aca)

The Affordable Care Act (ACA) brought significant changes to health insurance costs. One key aspect is the introduction of subsidies. These subsidies help lower-income individuals afford health insurance. For many, this means lower monthly premiums.

The ACA also expanded Medicaid in many states. This expansion provided coverage to more low-income individuals. Medicaid expansion reduced the number of uninsured people.

Another important element is the Essential Health Benefits. The ACA requires all plans to cover essential health services. These services include maternity care, mental health services, and prescription drugs.

Additionally, the ACA established Health Insurance Marketplaces. These marketplaces allow consumers to compare and purchase insurance plans. They provide a transparent way to see different options and costs.

Preventive services are another benefit of the ACA. Many preventive services are now covered without cost-sharing. This includes vaccinations and screenings.

- Subsidies for low-income individuals

- Medicaid expansion

- Essential Health Benefits

- Health Insurance Marketplaces

- Preventive services without cost-sharing

Overall, the ACA aimed to make health insurance more affordable and accessible. It also aimed to ensure comprehensive coverage for essential health services.

Recent Legislative Changes

Recent legislative changes have also impacted health insurance costs. The elimination of the individual mandate penalty is one example. Previously, the ACA required everyone to have health insurance. Without this mandate, some people may choose to go without insurance, affecting overall costs.

Short-term health insurance plans have also been expanded. These plans offer lower premiums but limited coverage. They are often used as temporary solutions. However, they may not cover essential health benefits.

Health savings accounts (HSA) and flexible spending accounts (FSA) provide tax advantages. These accounts help pay for medical expenses. HSAs are available with high-deductible health plans. FSAs can be used with various insurance plans. Both accounts lower out-of-pocket costs by using pre-tax dollars.

Another change is the expansion of association health plans (AHPs). These plans allow small businesses to band together to purchase insurance. They often offer lower premiums but may provide less comprehensive coverage.

| Change | Impact |

|---|---|

| Elimination of individual mandate penalty | More people may go without insurance |

| Expansion of short-term health insurance | Lower premiums, limited coverage |

| Increased use of HSAs and FSAs | Tax advantages for medical expenses |

| Expansion of AHPs | Lower premiums, less comprehensive coverage |

These recent changes can influence health insurance costs. Understanding these changes helps you navigate the evolving landscape of health insurance.

Frequently Asked Questions

How Much Is Health Insurance A Month For A Single Person In The Us?

Health insurance for a single person in the US typically costs $200 to $500 per month. Rates vary by state and coverage.

Is $200 A Month Good For Health Insurance?

$200 a month for health insurance can be good, depending on coverage, location, and individual health needs. Compare plans to ensure value.

How Much Money Should You Spend On Health Insurance?

Spend 10-15% of your annual income on health insurance. This ensures adequate coverage without straining your finances.

What Is The Average Cost Of Healthcare In The Us?

The average cost of healthcare in the US is around $11,000 per person annually. This includes insurance, medical services, and medications. Costs vary by state and individual needs.

What Factors Affect Health Insurance Cost?

Health insurance costs vary based on age, location, coverage level, and health status.

How Much Does Health Insurance Cost Monthly?

On average, health insurance costs between $200 to $500 monthly for individuals, depending on the plan.

Conclusion

Understanding health insurance costs can be challenging. Research and compare plans to find the best fit. Your choice impacts your financial and health well-being. Make sure to stay informed and review your options annually. This ensures you get the most value and coverage for your needs.